4IB is a private held investment company, mainly active in European technology companies at a operating or pre-operating stage. We invest in companies offering a sustainable and growth oriented business opportunity with perspective to multiply our investment. Our investments are directed towards highly innovative solutions, scalable business models to access international markets with agreed and identified exit paths.

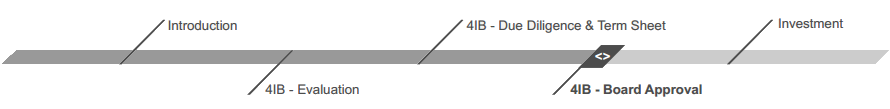

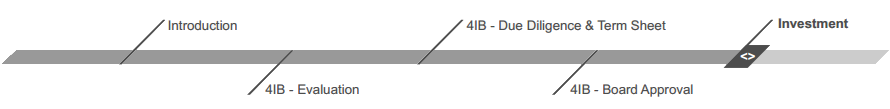

Follows five major steps, where each successfully taken step qualifies for the next one. To ensure best processing and in mutual interest we stay in direct contact to provide short term feedback to the submitting companies regarding their funnel status. Given our valuable expert and financial partner network and depending on capital need, 4IB can invest by its own or in syndication with international investors. Usually 4IB takes a more active role as an investor thus appointing a board management position where a skilled resources is needed.

// Introduction

Based upon your executive summary we assess the business idea and innovations involved regarding a potential match with our strategic investment plan; subsequently a technical and financial screening is done by our investment managers including business model, company team, market, intellectual property, technology and financial data. Given a potential match is there, the initial meetings shall enable both parties to exchange ideas and information to enable a more detailed evaluation.

// 4IB - Evaluation

Having assessed a positive potential of your proposal an in depth evaluation of innovation and markets is done along with internal review of possible next steps and assessment of long term expectations regarding success and exit scenarios.

// 4IB - Due Diligence & Term Sheet

In this phase we analyze in detail the feasibility, risk assessment and success criteria including financial modeling of business case as well as legal/IP matters that need to be considered. Usually this process requires significant resources and depends on productive cooperation of both sides as well as 3rd party support of market intelligence and legal experts. As a result a short summary of the potential invest case is prepared (term sheet) with detailed information pertaining invest size, legal terms, shareholder overview, draft payment plan.

// 4IB - Board Approval

In this phase 4IB takes the approval loop with final legal and financial details that need to be covered within the investment agreement. As final step contract is signed with investment and payment plan detail.

// Investment

Depending on the invest case and the status of your innovation and company, the first investment can range from a seed investment with a minor stake of 4IB in your company with option to extend the investment up to significant investment in more mature stage of company development.

4IB is a private held investment company, mainly active in European technology companies at a operating or pre-operating stage. We invest in companies offering a sustainable and growth oriented business opportunity with perspective to multiply our investment. Our investments are directed towards highly innovative solutions, scalable business models to access international markets with agreed and identified exit paths.

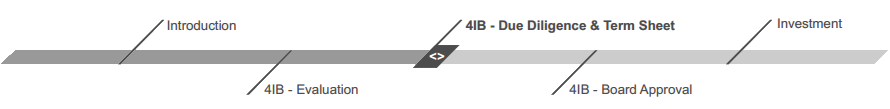

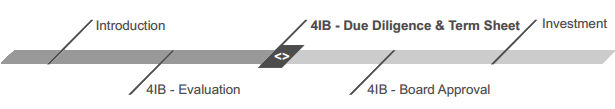

Follows five major steps, where each successfully taken step qualifies for the next one. To ensure best processing and in mutual interest we stay in direct contact to provide short term feedback to the submitting companies regarding their funnel status. Given our valuable expert and financial partner network and depending on capital need, 4IB can invest by its own or in syndication with international investors. Usually 4IB takes a more active role as an investor thus appointing a board management position where a skilled resources is needed.

// Introduction

Based upon your executive summary we assess the business idea and innovations involved regarding a potential match with our strategic investment plan; subsequently a technical and financial screening is done by our investment managers including business model, company team, market, intellectual property, technology and financial data. Given a potential match is there, the initial meetings shall enable both parties to exchange ideas and information to enable a more detailed evaluation.

// 4IB - Evaluation

Having assessed a positive potential of your proposal an in depth evaluation of innovation and markets is done along with internal review of possible next steps and assessment of long term expectations regarding success and exit scenarios.

// 4IB - Due Diligence & Term Sheet

In this phase we analyze in detail the feasibility, risk assessment and success criteria including financial modeling of business case as well as legal/IP matters that need to be considered. Usually this process requires significant resources and depends on productive cooperation of both sides as well as 3rd party support of market intelligence and legal experts. As a result a short summary of the potential invest case is prepared (term sheet) with detailed information pertaining invest size, legal terms, shareholder overview, draft payment plan.

// 4IB - Board Approval

In this phase 4IB takes the approval loop with final legal and financial details that need to be covered within the investment agreement. As final step contract is signed with investment and payment plan detail.

// Investment

Depending on the invest case and the status of your innovation and company, the first investment can range from a seed investment with a minor stake of 4IB in your company with option to extend the investment up to significant investment in more mature stage of company development.

4IB is a private held investment company, mainly active in European technology companies at a operating or pre-operating stage. We invest in companies offering a sustainable and growth oriented business opportunity with perspective to multiply our investment. Our investments are directed towards highly innovative solutions, scalable business models to access international markets with agreed and identified exit paths.

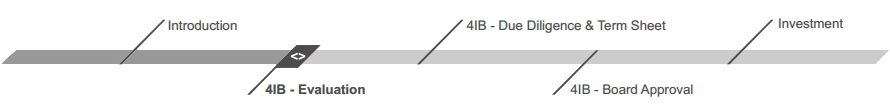

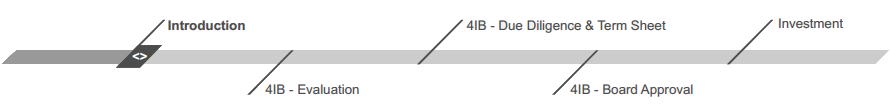

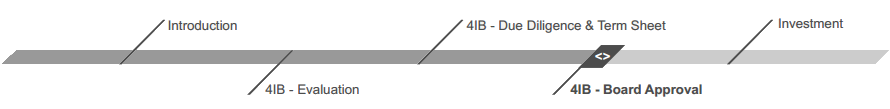

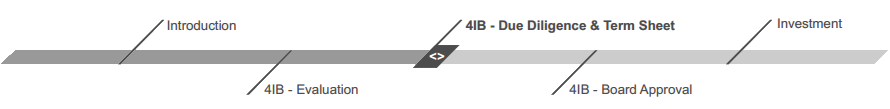

Follows five major steps, where each successfully taken step qualifies for the next one. To ensure best processing and in mutual interest we stay in direct contact to provide short term feedback to the submitting companies regarding their funnel status. Given our valuable expert and financial partner network and depending on capital need, 4IB can invest by its own or in syndication with international investors. Usually 4IB takes a more active role as an investor thus appointing a board management position where a skilled resources is needed.

// Introduction

Based upon your executive summary we assess the business idea and innovations involved regarding a potential match with our strategic investment plan; subsequently a technical and financial screening is done by our investment managers including business model, company team, market, intellectual property, technology and financial data. Given a potential match is there, the initial meetings shall enable both parties to exchange ideas and information to enable a more detailed evaluation.

// 4IB - Evaluation

Having assessed a positive potential of your proposal an in depth evaluation of innovation and markets is done along with internal review of possible next steps and assessment of long term expectations regarding success and exit scenarios.

// 4IB - Due Diligence & Term Sheet

In this phase we analyze in detail the feasibility, risk assessment and success criteria including financial modeling of business case as well as legal/IP matters that need to be considered. Usually this process requires significant resources and depends on productive cooperation of both sides as well as 3rd party support of market intelligence and legal experts. As a result a short summary of the potential invest case is prepared (term sheet) with detailed information pertaining invest size, legal terms, shareholder overview, draft payment plan.

// 4IB - Board Approval

In this phase 4IB takes the approval loop with final legal and financial details that need to be covered within the investment agreement. As final step contract is signed with investment and payment plan detail.

// Investment

Depending on the invest case and the status of your innovation and company, the first investment can range from a seed investment with a minor stake of 4IB in your company with option to extend the investment up to significant investment in more mature stage of company development.